Good Facts On Deciding On Ai Stock Predictor Sites

Good Facts On Deciding On Ai Stock Predictor Sites

Blog Article

Top 10 Tips For Evaluating The Model Transparency And Interpretability Of A Stock Trading Predictor

In order to understand how the AI predictor arrives at its predictions and how it aligns with your goals for trading It is important to evaluate the transparency of an AI stock prediction model. Here are 10 tips to evaluate the transparency of a model and its interpretability.

Revise the documentation and provide explanations

Why: Thorough documentation clarifies how the model functions as well as its limitations and how the model generates predictions.

How: Search for reports and documentation that describe the model's structure and features, as well as data sources, preprocessing. Understanding the logic behind predictions is made easier by explicit explanations.

2. Check for Explainable AI (XAI) Techniques

The reason: XAI techniques improve interpretability by highlighting the factors that most influence a model's predictions.

How: Verify that the model is interpretable using tools, such as SHAP or LIME. These tools are able to determine the characteristics of a model and then explain the individual predictions.

3. Consider the importance and contribution of each feature.

The reason: Understanding the variables that the model relies most on helps you determine whether it is focused on pertinent market factors.

How: Look at the order of contribution scores or the importance of the feature, which indicates how much each feature can influence the outputs of the model (e.g. volume, sentiment). This can validate the logic that underlies the predictor.

4. Consider the level of complexity of the model in comparison to. its interpretability

Why? Overly complex models are difficult to interpret. This could hinder your ability and confidence to make decisions based on forecasts.

How to: Assess the model's level of complexity in relation to your needs. Simpler models (e.g. linear regression or decision tree) tend to be preferred over complex black-box models (e.g. Deep neural networks).

5. Transparency should be a priority in the model parameters as well as in the hyperparameters

Why? Transparent hyperparameters offer insight into model calibration, which could affect its risk or reward biases.

How to document all hyperparameters, such as the learning rates, layers, and dropout rates. This helps you understand the model's sensitivity and adjust it to suit the market's different conditions.

6. Access backtesting results to see the real-world performance

What's the reason: Transparent testing can reveal the model's performance under various market situations, which gives an insight into the reliability of the model.

What to do: Read backtesting reports which show metrics (e.g., Sharpe ratio, maximum drawdown) across a range of time intervals and market stages. Transparency is crucial for both profit- and loss-making periods.

7. Examine the model's response to market changes

What is the reason? A model that makes an adaptive adjustment to market conditions can provide more accurate predictions. However, only if you are aware of how it adapts and at what time.

How do you determine how the model will react to market changes (e.g. market trends that are bearish or bullish) and if or when the decision is taken to alter the models or strategy. Transparency can clarify a model's adaptation to changing data.

8. Search for Case Studies or Examples of Model Decisions

The reason: Examples of prediction will show how models react in specific situations. This can help clarify the method of making decisions.

Request examples from previous markets. For instance how the model's response to the latest announcements or earnings reports. The model's underlying logic can be uncovered through thorough case research.

9. Transparency is a must in data transformations and preprocessing

The reason: Transformative processes (such as scaling or encode) could alter the way input data is displayed in the model and and impact the ability to interpret it.

Get documentation on data preprocessing, such as normalization and feature engineering. Understanding these processes can provide a better understanding of why the model prioritizes certain signals.

10. Check for model biases and limitations Disclosure

Why: Knowing that all models are not perfect will help you use them better, but without relying too heavily on their predictions.

What to do: Read any statements on model biases or limitations, such as an ability to perform better in specific market conditions or certain class of securities. Transparent limits allow you to stay away from overly confident trades.

If you focus on these points and techniques, you will be able to assess the AI prediction model's transparency and interpreability, giving you an understanding of how the predictions are made and helping you build confidence in the accuracy of the model. Follow the top rated best ai stock prediction for website tips including learn about stock trading, best site for stock, artificial technology stocks, market stock investment, artificial technology stocks, ai for trading stocks, chat gpt stock, stocks for ai, stock pick, trading stock market and more.

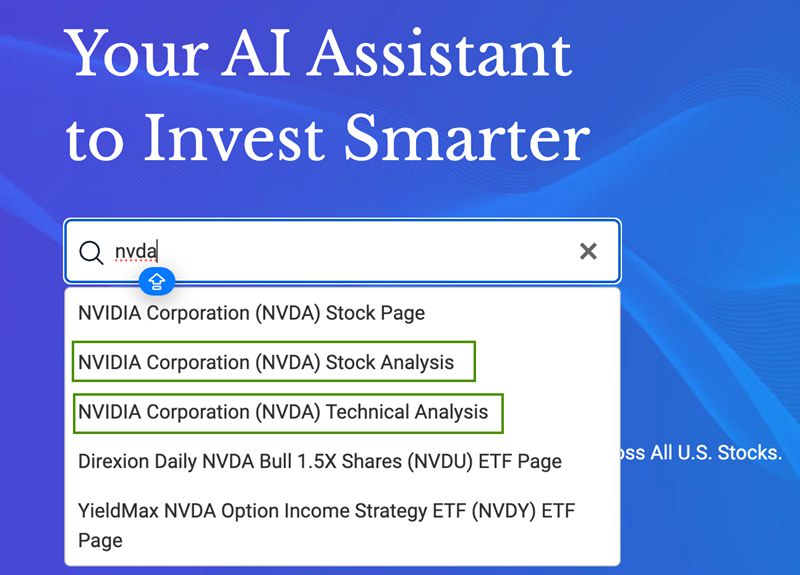

Top 10 Ways To Assess Nvidia Stock With An Ai Trading Predictor

To analyze Nvidia stock with an AI trading model, it is essential to understand the company's unique market location, its technological advancements as well as the larger economic aspects that affect the company's performance. Here are ten top tips to assess Nvidia using an AI stock trading model.

1. Learn about Nvidia's business model positioning, market position, and positioning.

What's the reason? Nvidia is a semiconductor manufacturer that is a major player in graphics processing and AI units.

What to do: Get acquainted with Nvidia’s main business segments which include gaming AI, datacenters, datacenters and automotive. The AI model can benefit from a better understanding of the market's position in order to evaluate the growth opportunities.

2. Include Industry Trends and Competitor analysis

What is the reason? Nvidia's success is affected by trends in the markets for artificial intelligence and semiconductors, but also by the dynamics of competition.

What should you do to ensure that the model is able to analyze patterns, like the development of AI applications, gaming demand and competitors with AMD or Intel. The inclusion of competitor performance will help provide context for Nvidia's stock performance.

3. Assess the impact of Earnings Reports and Guidance

Earnings announcements, particularly those for growth stocks like Nvidia, can influence the prices of shares.

How to: Keep track of Nvidia's earnings calendar and incorporate the earnings surprise into your model. Study how past price responses are correlated with earnings as well as the guidance for the future provided by Nvidia.

4. Technical Analysis Indicators

Why: Technical indicators help to identify the price trends and movements of Nvidia's shares.

How: Incorporate technical indicators like moving averages as well as the Relative Strength Index into your AI model. These indicators help to identify the entry and exit points when trading.

5. Macroeconomic and microeconomic variables

Why: Economic conditions including interest rates, inflation consumer spending, consumer expenditure can affect Nvidia’s performance.

What should you do: Ensure that your model is based on relevant macroeconomic indicators like GDP growth and inflation rates, in addition to specific industry indicators, such as semiconductor sales growth. This can enhance predictive abilities.

6. Implement Sentiment Analysis

The reason: Market sentiment could greatly influence the price of Nvidia's stock, particularly in the tech industry.

How to use sentiment analysis from news, social media, reports and analyst reports in order to assess the opinions of investors regarding Nvidia. This qualitative data provides additional background for predictions of models.

7. Production capability monitoring

What's the reason? Nvidia relies heavily on an international supply chain that is affected by global events.

How do you include supply chain metrics and news about production capacity or shortages in the model. Understanding the dynamics of Nvidia's supply chains can aid in predicting the potential impact.

8. Conduct backtesting against historical data

Why: Backtesting helps evaluate how well the AI model would perform based on previous price movements and incidents.

To test back-tested predictions, you can use the historical data on Nvidia stock. Compare predictions with actual results to assess precision.

9. Assess the Real-Time Execution Metrics

Why: The most important thing to do is to take advantage of price changes.

How: Monitor metrics of execution, like fill rates or slippage. Evaluate the model's performance in predicting the best entry and exit points for Nvidia trades.

Review Risk Management and Size of Position Strategies

Why? Effective risk management is crucial to protecting your capital and maximizing returns, particularly with shares that are volatile like Nvidia.

How: Ensure that the model incorporates strategies that are based on the volatility of Nvidia and the overall risk of the portfolio. This minimizes potential losses, while maximising return.

These tips will aid you in evaluating the AI predictive model for stock trading's ability to forecast and analyze movements in Nvidia’s stock. This will help ensure that it remains current and accurate in changing market circumstances. Read the top rated stock analysis ai for site examples including stock market analysis, stock investment prediction, stock analysis websites, artificial technology stocks, learn about stock trading, ai stock picker, ai companies to invest in, artificial intelligence stock price today, stocks and investing, stock picker and more.